In November of 2010, serious collectors of Chinese antiques gasped when an 18th-century Qianlong porcelain vase (right), which was expected to fetch no more than £1.2 million at a modest West London auction house called Bainbridges, brought £43 million. The buyer’s premium of 20 percent, plus the English VAT, pushed the final price above £53 million.

The vase gained notoriety because a 54-year-old man named Anthony Johnson and his 85-year-old mum found the piece amid other items inherited from the mother’s sister. It seemed like the ultimate pick, and the news no doubt sent untold numbers of would-be millionaires into their attics and basements in search of the next big thing.

Problem is, the man and his mom have yet to be paid for the fortuitous find. At first, conspiracy theorists darkly suggested that the sale had been foiled by the Chinese government’s Lost Cultural Relics Recovery Program—the vase appears to have been fired in Imperial kilns and was likely stolen from China during the Opium Wars of the mid-19th century.

But recently, experts have decided that the buyer is probably just chafing at the prospect of paying the full 20 percent buyer’s premium.

Bainbridges is not Sotheby’s or Christie’s, who have enough experience with big-ticket items to build sliding scales into their fee structures. A quick check of the calculator shows that such a fee structure would probably have reduced the buyer’s premium by a couple of million pounds.

Bainbridges is not Sotheby’s or Christie’s, who have enough experience with big-ticket items to build sliding scales into their fee structures. A quick check of the calculator shows that such a fee structure would probably have reduced the buyer’s premium by a couple of million pounds.

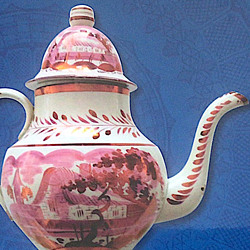

If Bainbridges is not paid, the auction house may have the right to list the vase again, leaving the Johnsons to go through the anxiety of wondering if lucrative lightning could possibly strike twice. Regardless of what happens to their treasure, on March 24, 2011, Bainbridges will auction its latest found vase (left), an 18-inch tall, late-19th century De Morgan. The piece is expected to bring between £4,000 and £6,000.

How Collecting Opium Antiques Turned Me Into an Opium Addict

How Collecting Opium Antiques Turned Me Into an Opium Addict

Unraveling the Ancient Riddles of Chinese Jewelry

Unraveling the Ancient Riddles of Chinese Jewelry How Collecting Opium Antiques Turned Me Into an Opium Addict

How Collecting Opium Antiques Turned Me Into an Opium Addict Blood, Sweat, and Steel: My Afternoon with the Ace of Swords

Blood, Sweat, and Steel: My Afternoon with the Ace of Swords Chinese AntiquesWhen thumbnail histories of all sorts of technologies are written in the We…

Chinese AntiquesWhen thumbnail histories of all sorts of technologies are written in the We… Asian VasesWhether they're high-shouldered or pear-shaped, rounded at their waists or …

Asian VasesWhether they're high-shouldered or pear-shaped, rounded at their waists or … Mari Tepper: Laying it on the Line

Mari Tepper: Laying it on the Line Nice Ice: Valerie Hammond on the Genteel Charm of Vintage Canadian Costume Jewelry

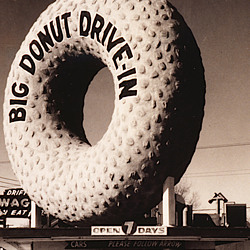

Nice Ice: Valerie Hammond on the Genteel Charm of Vintage Canadian Costume Jewelry How Jim Heimann Got Crazy for California Architecture

How Jim Heimann Got Crazy for California Architecture Modernist Man: Jock Peters May Be the Most Influential Architect You've Never Heard Of

Modernist Man: Jock Peters May Be the Most Influential Architect You've Never Heard Of Meet Cute: Were Kokeshi Dolls the Models for Hello Kitty, Pokemon, and Be@rbrick?

Meet Cute: Were Kokeshi Dolls the Models for Hello Kitty, Pokemon, and Be@rbrick? When the King of Comedy Posters Set His Surreal Sights on the World of Rock 'n' Roll

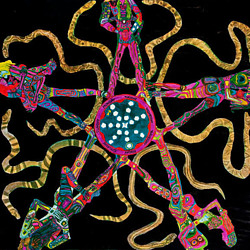

When the King of Comedy Posters Set His Surreal Sights on the World of Rock 'n' Roll How One Artist Makes New Art From Old Coloring Books and Found Photos

How One Artist Makes New Art From Old Coloring Books and Found Photos Say Cheese! How Bad Photography Has Changed Our Definition of Good Pictures

Say Cheese! How Bad Photography Has Changed Our Definition of Good Pictures Middle Earthenware: One Family's Quest to Reclaim Its Place in British Pottery History

Middle Earthenware: One Family's Quest to Reclaim Its Place in British Pottery History Fancy Fowl: How an Evil Sea Captain and a Beloved Queen Made the World Crave KFC

Fancy Fowl: How an Evil Sea Captain and a Beloved Queen Made the World Crave KFC

Leave a Comment or Ask a Question

If you want to identify an item, try posting it in our Show & Tell gallery.